Born from Pain. Built to Empower.

Banking for the Financially Invisible

KrillPay gives financial visibility to millions of migrants and unbanked users — connecting them to a borderless world of banking, transfers, and opportunity.

Meet Johny, Avelo & Akpan

Real people. Real Struggles. Real Transformation.

Akpan

Akpan was paying Western Union and MoneyGram prices that made him sick. When he found KrillPay, everything changed: instant transfers with $0 in transaction fees, virtual cards that work everywhere, a named bank account to receive payroll, and an app that treats him like the valuable customer.

One app. Zero friction. 100% empowerment.

Making Financial Inclusion a Reality

We're bridging the gap between traditional banking and underserved communities, one transaction at a time.

340M +

Unbanked To Serve

Across U.S. & Africa

$Millions+

Transferred Annually

Supporting families worldwide

2 +

Continents Connected

Seamless cross-border payments

98.7%

Customer Satisfaction

Trusted by our community

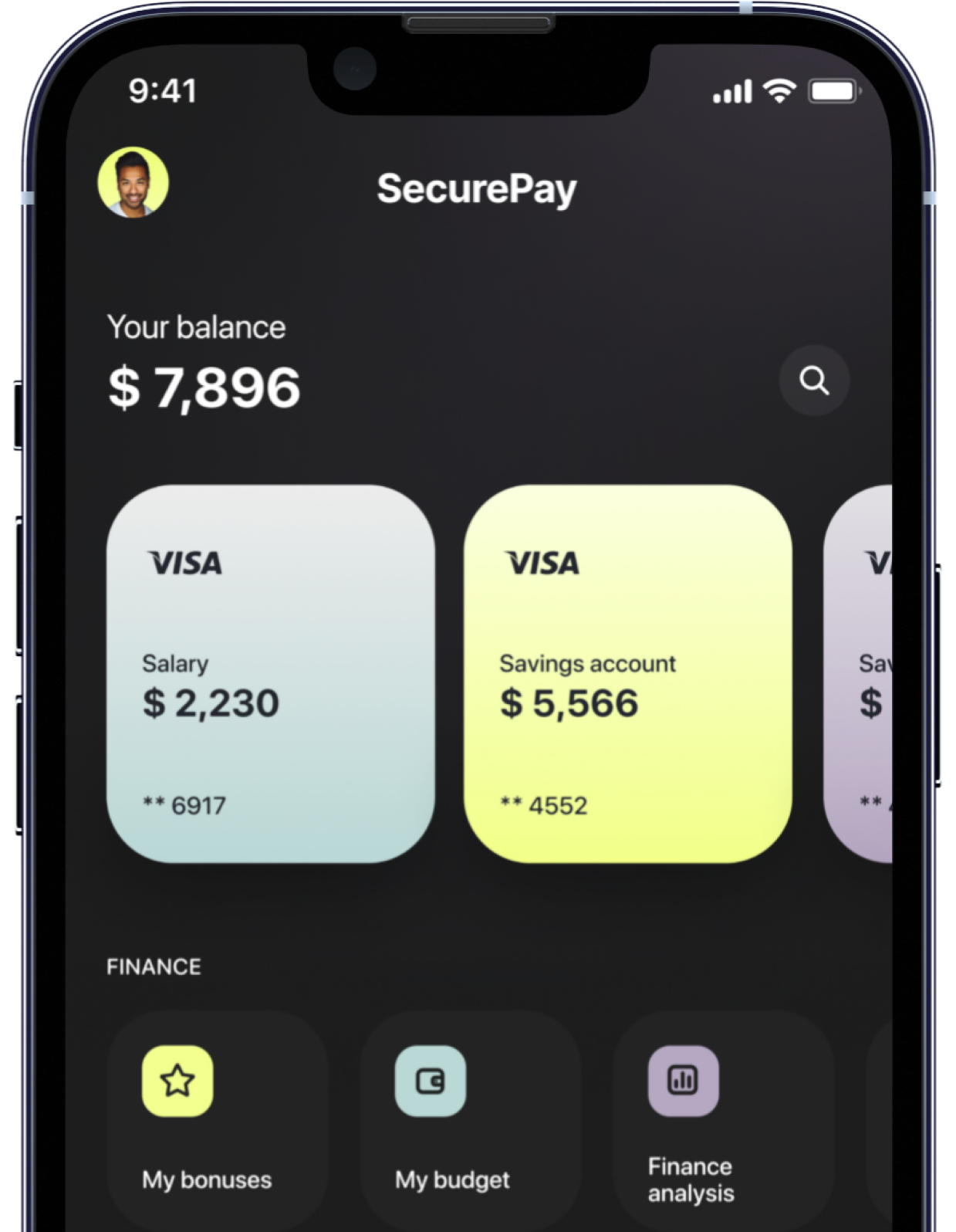

Complete Financial Services in One App

Everything you need to manage money, build wealth, and support your family locally or across borders.

Cross-Border Transfers

Send money home instantly with zero fees and real-time exchange rates.

- Instant transfers to 20+ countries

- No hidden charges

- Real-time tracking notifications

- Best-in-class exchange rates

Domestic P2P Payments

Split bills, pay friends, or send money locally with zero friction.

- Instant peer-to-peer transfers

- QR code payments for merchants

- Bill splitting with groups

- Request money seamlessly

Virtual Cards

Shop online and in-store with secure debit cards linked to your account.

- Instant virtual card creation

- Physical card shipped free

- Contactless payments enabled

- Real-time spending alerts

Credit Building Tools

Build your credit history and access financial opportunities.

- Credit score monitoring

- Responsible credit products

- Financial literacy resources

- Path to traditional banking

Secure Savings

Earn competitive interest while your money stays safe and accessible.

- FDIC-insured accounts

- Competitive interest rates

- No minimum balance required

- Automated savings tools

Bill Payments

Pay utilities, phone bills, and subscriptions directly from your account.

- Support for international billers

- Scheduled automatic payments

- Payment reminders

- Transaction history tracking

Simple, Fast, Secure

Send money home in five easy steps. No complicated forms, no long waits, no surprises.

Create Your Account

Download the app. Sign up in minutes with phone number, email, and basic information—no credit check required.

Complete KYC Verification

Verify your identity with a government-issued ID and selfie. This secure process ensures the safety and compliance of your account

Connect Bank

Link your bank account or debit card (coming soon). Deposit into your wallet. Your money is FDIC-insured and ready to use.

Send or Receive

Initiate your first transfer to either domestic or international users, directly to their wallet or a bank account. They receive funds instantly.

Track & Confirm

Get real-time notifications at every step. Your recipient confirms receipt, and you both get transaction records.

Built for Real People, Build for Real Needs

Whether you're sending money home, receiving funds from family, or building your first credit history, KrillPay has the right solution for you.

Migrant Workers & Families

Send Money Home with Confidence

You work hard away from home to support your family. We make it easy and affordable to send money back, with instant transfers and transparent fees.

What You Get:

- Send to 20+ countries instantly

- No hidden fees or surprise charges

- Multiple receipt options for recipients

- Track transfers in real-time

- Real-time support

Unbanked & Underbanked

Your Path to Financial Services

No credit history? No problem. We welcome everyone who wants to build a better financial future, starting with basic banking services that grow with you.

What You Get:

- No credit check required

- Build credit history over time

- Free financial literacy resources

- Path to traditional banking products

- No minimum balance requirements

Small Business Owners

Accept Payments, Grow Your Business

Accept payments from customers across borders, pay suppliers internationally, and manage business finances all in one platform built for entrepreneurs.

What You Get:

- Low-cost merchant accounts

- Low-cost payment processing

- Request for payment tracking

- Get paid faster

- Export data to accounting tools

Recipients in Africa & LATAM

Receive Money Instantly, Build Wealth

Receive funds from family abroad directly to your phone, withdraw cash from local agents, or use your virtual card for online purchases and bill payments.

What You Get:

- Instant mobile money delivery

- Zero Cash pickup locations needed

- Virtual card for online shopping

- Pay bills and buy airtime

- Save and earn interest locally

Still not sure which service is right for you?

Talk to our team and we'll help you find the perfect solution for your needs.

We understand the importance of connecting people across borders with ease and efficiency. Our Cash Wallet is designed to offer a hassle-free solution for individuals and businesses looking to transfer money internationally. With cutting-edge technology and a user-friendly interface, our platform ensures fast, secure, and cost-effective transactions, making global remittance as simple as sending a text message. Whether you're supporting family abroad or conducting international business, our Cash Wallet is your reliable partner in financial connectivity.

Building Communities, One Transaction at a Time

Every time you send money home, a portion will go toward building schools and funding financial education in underserved communities. Your financial transactions become investments in the future.

We understand the responsibility of handling your hard-earned money. That's why we've built enterprise-grade security into every layer of our platform.

Your Trust is Our Foundation

Bank-Level Encryption

256-bit SSL encryption protects every transaction and personal data point.

Multi-Factor Authentication

Biometric and SMS verification ensure only you can access your account.

Real-Time Monitoring

AI-powered fraud detection monitors transactions 24/7 for suspicious activity.

FDIC Insured Accounts

Your Named account deposits are insured up to the limit of the FDIC.

Regulatory Compliance You Can Trust

We work with regulatory bodies across the areas where we have presence to ensure full compliance with financial regulations, anti-money laundering laws, and consumer protection standards.

Licensed Money Transmitter

In partnership with regulated entities and FinSec

SOC 2 Type II Certification

In progress with independently audited security controls.

Meeting PCI DSS Compliance

In progress- highest security standards.

Our security Promise

- We never sell your personal data to third parties

- Your funds are segregated and protected in FDIC-insured accounts

- 100% fraud protection guarantee on all transactions

- 24/7 security team monitoring for threats

- Transparent privacy policy in plain language

- Regular third-party security audits

Standart

Free

Free account

Virtual cards

Online transactions

Top rated support

Online banking

Premium

$25/ Mo

All features

Cryptocurrency

Travel insurance

Free pay worldwide

Top rated support

Partners discounts

Flexible pricing plans.

Choose a plan that suits your business needs and budget. SecurePay provides a reliable and secure payment solution for your business.

Instant transactions

Personalized insights

Real-time alerts

Efficient bill payments